Scenes from a Bear Market

Is this bear market different than the last one?

Welcome to this week’s edition of RHIZOME WIRE!

History Rhymes

Earlier this week, as BTC dipped once again and brought many altcoins with it to lows not seen in some time (including ICON nearly reaching ICO price), an apocalyptic sentiment has once again started to creep through cryptocurrency social media channels. As people watch their holdings continue to shrink, we’re seeing another wave of “altcoins are going to zero” Tweets and reddit posts declaring cryptocurrency officially dead.

This is a sampling of what’s seemingly been showing up in my Twitter timeline more and more over the past few weeks:

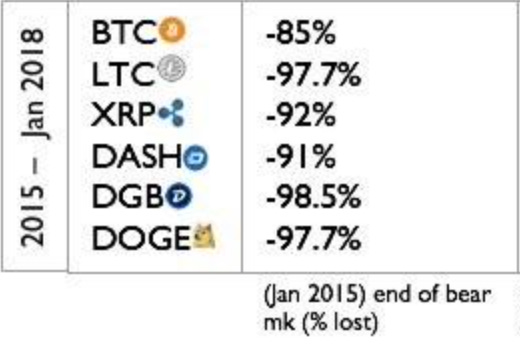

As this was happening, I happened to stumble upon a chart posted on reddit last year that gave a bit of perspective:

While the chart itself focuses on trying to determine if alts are a better investment compared to BTC, the key takeaway I had was just how dramatic the crash from the prior crypto bear market was. Here is a zoomed in image of that section:

Most of the tokens listed in this image have seen similar percentage decreases during the current bear market. Here is a tweet from a thread I created to show this:

Based on the similarity of these figures (the magnitude of % decreases during both the 2014-15 and 2018-19 bear markets), there is a clear historical comparison to be made here, at least from a numbers standpoint. The magnitude of the crash in 2014-15 is very similar to the magnitude of the crash in 2018-19.

This led me to wonder: during the prior bear market, was sentiment as bad then as it is now? Were people seemingly throwing in the towel? Were people asking if their favorite token was officially dead due to the price drop? Was the assumption that the party was over for good?

So I was inspired to put myself through a bit of a time warp to see just what sort of attitudes were prevalent back then and if they compared at all to the attitudes of today.

After spending a chunk of time doing this, one thing became clear: if you removed the timestamp from some of these comments, you’d have a difficult time determining if a statement was made in 2014/15 or in 2019. It is as though we’re simply watching the same exact movie over again.

Below I have compiled some of the greatest hits. Keep in mind, searching through reddit and BitcoinTalk posts from 4-5 years ago is no easy task, so I believe this is ultimately just the tip of the iceberg.

Litecoin

Litecoin is Officially Dead When We Go Sub $1.90

“If we go sub $1.90 it is officially dead. All hope will be lost. $2 was the psychological level, we're below 2 now. It's also below 0.007 BTC. If LTC goes sub $1.90, there's nothing that could stop it from going below $1.00. If that happens, Litecoin will be on the same level as forgotten coins like NMC, PPC, etc; just another dead, pumped coin.

It's obvious that the Chinese volume is fake. If it was real, the price would have gone up a long time ago.

Litecoin has dropped 96.5%, almost 97%, compared to its ATH. Anyone telling you that this coin isn't dead is simply in denial.”

- January 8, 2015 - LTC would fall to $1.29 a few days later…and then ultimately reached $375.29.

(Comment in thread): Yeah, let's ignore the fact that Litecoin has been going down for months, and that someone just dumped over 300,000 Litecoins. Lets ignore that whenever BTC goes up, LTC doesn't, but whenever BTC goes down, LTC does too. LTC is hopeless. I regret buying LTC, this is going nowhere I am afraid.

- July 1, 2014 - LTC price was $7.98

Battling with myself over buying LTC

I just purchased my first BTC today with the intention of converting some of it to LTC. I have been struggling with the idea today because there just seems to a lack of interest in LTC lately. Just viewing the sub, there appears to be very little going on. There is some merchant adoption, but overall interest in it seems to have weakened quite a bit. Am I missing something or another valuable source of information and news someone can provide? By no means am I saying "LTC is dead" but it just looks a little dismal from an outsiders perspective. Thanks”

- December 8, 2014 - LTC was $3.65

There's been a lot of chat about other coins and that is precisely why those coins will not rise any time soon; hardly anybody saw this LTC surge coming and that's why it paid so well! No-one was predicting $1 for LTC until recently let alone $10, $20 or $50. Many are making such claims and yet this run has already begun to stagnate, trade volume is dropping, it's off it's highs and has experienced some crazy downward swings, people are placing big orders for new hardware and the difficulty is sharply rising. Mining profits have already begun to take a huge dive.. if you're buying at these levels to hold and purchasing equipment to mine at the same time, you're about to get fucked twice.

The opportunity to make easy money has long passed. Even if you got in at 50c, you were catching the tail end of the surge despite how good of an entry price it appears to be.

- May 31, 2013 - LTC was $3.28

Verdict: Litecoin is dead, it hasn't been updated in years, it's a practically abandoned coin. I'm gonna feel really sorry to all the litecoin bagholders that are still "HODLING" when Litecoin reaches $1, 50 cents, 10 cents etc.

-June 19, 2014

Ripple

Is XRP just a short term pump and dump?

After XRP recently reached it's ATH, the price has been corrected significantly and this subreddit is dead. I'm not trying to spread FUD, but i'm confused as to why bigger companies with smarter people such as Google and Apple haven't just created their own stuff if cryptocurrency is indeed solving real world problems. Is cryptocurrency even necessary for non crypto people, are all of the crypto's just ponzi schemes? I really want to believe, but over time I rarely see any smart people talking about crypto, only those people on youtube saying they are investors with portfolios worth 500 USD that look like people in MLM stuff. I really want to believe, but so far I'm losing faith as I have considered from bank's perspective why would banks even want to use this magic internet money. If it's an actual problem some well established company should have already made a solution by now, starting to think all of this is just hype then dumping on new "investors" trying to make money. Please correct me if I am wrong, I really want to believe, I am hodl'ing, but after recent events this is starting to seem shady. Thanks for the downvotes by the way, some of you guys are a little unrealistic...

- May 19, 2017 - XRP was $0.34; it’s ATH prior to that was $0.42. It would eventually reach $3.84.

Ripple's XRP at 1 cent per XRP, is it dead as a currency?

So according to here ripple native currency, XRP is worth $0.01. Does this mean that it is pretty much dead as a currency?

- March 27, 2014 - XRP was indeed 1 cent, down from an ATH of 5.8 cents the prior December.

Dogecoin

:( :( :( :(

- June 17, 2014 - DOGE was $0.000365, down from $0.001934. If you had bought DOGE the day this comment was made, your ROI at ATH would have been 5043.29%

I am probably getting downvoted but this is a serious question. The public interest and the price is very low and also the interest in donating.

If you ask me I think that the 5 billion dogecoins yearly are breaking dogecoins neck but that is my opinion, what do you think? Is Dogecoin going to survive or is it dead?

- January 8, 2016 - DOGE was $0.000173. If you had bought DOGE the day this comment was made, your ROI at ATH would have been 10,751.4%

Doge used to be one of my favorite altcoin but it seems that it's not gonna recover to it's former state.

Is their hope for Doge? What can you say about the big drop of Doge?

- September 3, 2017 - DOGE was at $0.002143.

General / Other

General talk about the prices of alts, I tried to sum-up what it's all about, give you my opinion

I myself am the victim of such thinking and have lost so much money on Vertcoin which seems to go only down (along with most other altcoins) and as a bagholder I'm just hoping it rises together with Bitcoin, in the next big bubble. In the other hand, I have reasons to believe the next big Bitcoin bubble won't come soon, if it comes at all... All the geeks are already in and Average Joe seems not capable of understanding the importance of cryptocurrencies, and everything is still not regulated enough (or even banned) and big guys don't want to play too much in such circumstances. And finally, it's really not the same if price of Bitcoin was ~120$ on the previous "starting" point, compared to todays ~600$. Much more fiat money is needed to fuel next bubble. Also, there are big merchants coming in and short-term effect is bearish because they probably sell coins once they acquire them.

- July 27, 2014

(Comment in same thread): Hope is not a good investment strategy. I believe the days of explosive growth are history. It's now a time of incremental growth due to fierce competition. Knowledge and patience are your best friends. If a coin has good fundamentals, a thriving community, dedicated developers and a clear road map, then I might invest in it. On the outside, Vertcoin looks like good pick. However, there are at least a dozen others its equal and not enough investors hence the price drop.

Soooooo, what the hell is happening with this industry?Is a "Mass Extinction" of altcoins coming?

Are cryptocurrencies other than bitcoin going to be here in the next 3 months? It certainly doesnt look like it. My history speaks for itself, Im not a shill or a FUD starter, in-fact, Im a genuinely worried GPU miner who is afraid of not seeing his ROI on several thousands of dollars worth of mining gear.

CPU and GPU miners are out of the game now I guess, nothing left to mine other than vertcoin, which is why the price is falling on it so rapidly, because every GPU miner and their mother is mining it. Why are there even networks anymore to begin with? Am I missing out on something or are there tons of people mining at a loss right now?

- July 17, 2014

Is Stellar dead or dying? I'm confused.

In the beginning everything seemed to slick and promising. It had all the hallmarks of a massive and professional platform innovation.

But these days the price is spiraling, the subreddit is basically a ghost town and their own stellartalk.org forums get about two posts a week.

Is there something I'm missing, is the community active elsewhere, or is the entire project essentially now a vegetable?

- October 17, 2014 - XLM was $0.002. It would eventually reach 98 cents.

General discussion about cryptos. Ones who think I'm FUDing or trolling may f/k off.

I'm starting to be pessimistic about it all, and I even think we may not witness next Bitcoin bubble in near future... Here's why:

All the geeks and early adopters are in. Who is still left-out is ignorant mass which can't comprehend Bitcoin incentives over Paypal, nor they can see it actually heals the worldwide economy. Yes, we're waiting for a big investors too, but I doubt they will enter such unregulated market which is public enemy nr. 1 of states and banking system. Finally, billionares are billionares just because of the corrupted fiat money system, and actually they kind of chopping off the branch they're sitting on.

Price of Bitcoin: new Bitcoins are released every day and we need about 1.5mil$/day just to keep the price stagnant. It's really not the same like Bitcoin was 100$ before the previous bubble. Much more fiat is needed to fuel the rise. You can see it as 5x more people is needed to be aware of it all. I doubt there is 5x more people in cryptos now than there were in October 2013.

Remember, previous Bitcoin bubble was fuelled mostly by Mt.Gox failure (someone artificially made USD credit on their site and was constantly buying) + "China is coming" effect. Those were 2 big (positive) circumstances, and it was pure luck for Bitcoin's price, so it wasn't too much about the real demand, it was about stealing and speculator's game.

Too many altcoin parasites which are dispersing energy (and money). Actually I realised maybe even it would be better for worldwide economy that Bitcoin stayed closed source, forged in honest very small community of most advanced developers. *Big holders may decide that they exit the game and effectively kill the price to the ground. Specially, I am affraid of 1 mil BTC owned by Satoshi. Would be good for Bitcoin if he is not among us anymore so the private keys are lost ;)

Sadly, I realize Bitcoin is "liberalist wet dream", but can easiliy be failed one. Combination of ignorant mass which is easily manipulated + interests of elite that is state and banksters, and I see it may really stay on the margin of worldwide economy, say it takes only about 10-20% of electronic payments and money transfers worldwide. That's not a win, that is huge fail compared to what we were thinking it may become.

So I played the Devil's advocate this time, and ask me what do I think about alts? Right now, they're fuckin' dead, including "silver to bitcoin's gold". Only chance for them is to rise along with Bitcoin. Astronomic rise of Darkcoin was not the healthy demand by the masses for spending it, it was speculator's game. After the initial boom and crash, we will see a slow decline, every fairly successful altcoin has the same history and future: One bubble and then the second one purely dependent on Bitcoin.

- August 15, 2014

Comment: The reason I am bearish.

As soon as people get tired of waiting for a new all time high, everything will disintegrate. The ONLY reason so many new people have been interested the last few months is because of the constant new all time highs. Sorry to point this out. Even if every transaction in ETH saved a life, people will stop caring immediately as it seems like the bubble is over.

How enthusiastic can you Be when great news comes out week after week and the price only drops. And people thing it is because ETH is worthless and pointless because the price is going down, rather than the price is going down because it was pumped to much.

Just like you ETH bulls think the price rising is because of how innovative ETH is, when in reality it is just a large alt bubble (a big one, about the same as litecoin).

- March 24, 2016

the altcoin scene is long gone, i can certainly say that it was dead in late 2014 already, the last attempt was with burst and dash coin

i would avoid it completely now, there is no profit to be made, it's just scammers scamming each other

- November 1, 2015

And of course, the hundreds of times Bitcoin has been declared “dead.”

Meanwhile, some individuals who survived the prior bear market have stepped in to provide some perspective for those currently living through the current bear market. Here are some key responses to the question: “Who was here and survived the last big crash in crypto in 2013 and how does that compare to now?”:

“Despair was long gone. We all just lost interest at all. And then suddenly it was back alive.”

“I don't think it's very different. Lots of regret for people who didn't sell. Lots of people complaining about margin shorters. People rage quitting or just leaving for good. Calls for insane prices like $99™, now $999™. "good news" makes zero difference in the trend. General dogshit sentiment.”

“I was there, and it's hard to compare. It depends a lot on your personal perspective.

I've hodled through all the bubble (I went into BTC very early so I was profitable even after crash). Fortunately haven't lost all my coins on MtGox, but I was VERY exhausted and full of regrets for holding, I promised myself "never hold again" (and I kept the promise). It was my third bubble (first BTC bought in 2011).

On all the way down I was making crazy stupid longs, hoping that it'll rebound, so I was actually losing in terms of BTC, not only USD.

I spend quite a few sleepless nights, watching the charts as if it could change something.

Then there was a rally (like +50%) which gave false hope. It went down very fast.

After that market went sideways, for long time. So I was like "fuck it, I'll hold and see what happen". After many months there was like -40% dump, and I said to myself "no, this is too much. not only I failed to realise profits when BTC was $1000, I could even go unprofitable if it would go down another -40% ( and why not?)."

So I said "I'll sell half on rebound", which I did, and I regret this so much. Few weeks after this BTC started its climb.”

“This. The space was really relegated to bitcoin, but in the wake of the Silk Road investigation and prosecution, the MTGOX debacle, and the generally agreed-upon notion that the bubble had irreversibly popped, it felt like the space had just closed up shop.

I and many others walked away with our bitcoins and likely sold them all off over the coming years. I didn't wake back up to crypto until early 2016 when I first heard about ethereum and started to buy. Wish I'd been alerted to it in 2015, but I'd just assumed that the whole space had died.

Now, despite the price action, the only fear is that the price won't be as high as it was in January 2018. Nake price speculation can make markets rise to incredible heights and crumble to unthinkable lows. But at least there is a foundational technology out there which is not going away anytime soon.

So, yes, while this stings (incredible for some, less so for others), I am confident that the future is much brighter than the price action we've witnessed over the last year.”

The question, “Is This Crypto Bear Market Different Or The Same?” elicited the following reflections:

“2013 stands out as the worst in my memory. I bought in halfway up the parabolic in April thinking that it finally found its legs and was going mainstream. When it tanked, the same talk about how Bitcoin was “over” was being thrown around. Then again in November, with the same “Bitcoin is dead” mantra. 2014 was dormant, but I decided to buy up more, holding through and basically forgetting about my holdings until 2015 when I heard about Ethereum. In 2016, I used some of my gains and more fiat to buy in at $11, only to have it dip through the beginning of 2017, forgot about it for another few months, checked my balance in May of 2017 and just about shat a brick. In my experience, the market has the memory of a fish and forgets about even the bloodiest of times. I have my positions now and will hibernate for another year or so. I’ve cashed out nearly all of my initial investment, so I’m letting it ride because I believe that it’s the future of money.”

“I'm not alone, atleast I don't think so, but I would be considered a crypto elder.

I'd have to double check the years, but I definitely remember the dollar amounts. The December when I had thousands of Litecoin and it hit $48. Christmas dinner was great. That whole following year, crypto crashed, down down down, slowly, the slow death, much like how this feels, but this is nothing compared to that. I remember thinking how crazy it was people were paying $60 for Eth, and there were like 15 coins total on CMC, and it was fairly new so they were just adding coins like crazy and I remember when we finally had 100 coins and everyone was like, this is craziness...we don't need 100 coins.

Anyways, everything came back, and it was great, and the process continued every year or so, this is no different. I assure you, ASSURE you, the coins in the top 100, will be back to where they were and more, breaking records, people going into frenzy, rinse and repeat.”

“But after a while, in 2015, few people even cared anymore. The market was at an almost complete standstill for a whole year. No pumps, no dumps, just sideways, seemingly forever. And so people simply lost interest, many started to suspect that nothing interesting would ever happen in crypto again. There was no frustration, because there were no expectations. Even if you were a hopeful bull, you didn't stay glued to the charts, chatting in reddit dailies etc like people do now. You just held the coins and waited, either with great patience, or because you almost forgot you had them.”

I think by now you get the point.

Remember how things felt during the top of the bull market? People would refresh their phones and see their portfolio’s spike in value in minutes. Any piece of news would cause a price pump. There was a sense that prices wouldn’t ever stop going up. Who would ever want to sell? People taking out loans to buy crypto. Every other reddit user believing they were a genius investor. Every new ICO was the “next” coin to really go off.

In hindsight, it’s amazing that anyone would have been able to stay emotionally sober in that environment - and very few people actually did.

Now, we’re in the inverse. It seems as though prices won’t stop dropping. Positive news does nothing to the price. There’s a sense that everything except BTC might just go to zero. Who would ever want to buy after watching everything lose such value?

In general, the arguments that came up the most during the prior bear market as to why there wouldn’t be another bull market were:

Anyone who would potentially invest in cryptocurrency already has — and they got burned and won’t want to return. So the pool of “new money” is basically non-existent.

There are too many projects now - see the quote above stating “we don’t need 100 tokens.”

There isn’t any adoption or use cases.

None of these reasons — regardless of if they were true or not — prevented the 2017 bull market.

Does all of this mean prices will stop going down anytime soon? Does it mean the next bull run is around the corner? Who knows. There’s always a chance that 2017 was really “the last one” -- but history indicates otherwise.

More importantly, fundamentals say otherwise too. Compared to 2017, most projects that are still alive have made great progress, either in terms of technology, business development, adoption, or other critical fundamentals. That makes them more attractive as investments, not less. Don’t get me wrong, many tokens that were part of the ICO boom are certifiably dead — but many others have come a long way in terms of development of both their technology and use cases.

As horrible as things seem right now, they’ve seemed far worse before, and things turned out alright. You might think “this time is different” - but, as the quotes above show, that’s what people thought in 2014/2015 as well.

Oh, and in case you forgot, here is how those coins that were initially mentioned performed during the 2017 bull run (after their dramatic crash in 2014/15):

News from ICONWorld

We’re flush with cash

In a Telegram chat this week, Ricky Dodds stated the following:

The foundation controls $50mm+ in funds which includes icx treasury and eth raised. I don’t have the exact amount of eth raised left (but I think it’s safe to assume it’s around 1/2 remaining, spread across a number of assets), or a line by line expense report over the past 2 years but I can give you some information that I hope helps.

So, hopefully, we can finally put an end to the “ICON is running out of money” FUD that has percolated from time to time. Meanwhile, the figures Ricky stated don’t count the revenue the Foundation will continue to receive from both their staking and P-Rep rewards, both of which are significant.

My-ID Partners Day Video

If you didn’t get a chance to see it yet, ICONLOOP put out a short video documenting the launch of the My-ID Alliance earlier this month. While the text is mostly in Korean, it’s still nice to see footage from the milestone event!

Breaking down iRep

ICON (ICX) i_rep Economics - POS Bakerz - an ICON P-Rep - has written a helpful article explaining what the iRep metric is, its impact on the network, and whether or not it should be higher or lower, providing their own insight into the issue. For those unfamiliar with ICON’s IISS, it’s an important piece of the puzzle, and POS Bakerz explanation is definitely helpful. For those who already have an understanding of IISS and iRep, it’s edifying to hear their perspective on the current debate surrounding IISS. Here’s a brief excerpt:

While lowering i_rep can be a good decision, we believe that it should be taken by consulting the overall ICON community. There are a couple of issues that have to be solved with the current IISS mechanism, and these issues are being debated in the forum. Yes, large P-Reps are getting too many rewards, and yes, lowering i_rep would mean lowering their rewards as well as the inflation of the network. But this would also mean lowering the rewards of many lower-ranked representatives, including Sub P-Reps, which currently have little incentives to be proactive in the network.

my-ID in the mainstream

South Korean Blockchain ICON (ICX) Hits Mainstream News. Signs of Things to Come.

Mineable, a current P-Rep, posted an overview of the My-ID Alliance on his personal website. The write-up provides a nice overview of the alliance, what it means for ICON, and why it could be important to the future of the project and blockchain in general.

Corey does it again

Corey Costa of P-Rep ICONVIET is out with yet another episode of the Democratic Chronicles. This time, he had the chance to interview Ben Choi, “a prominent community member with a huge amount of developmental expertise.” Here’s Corey’s description of the entire episode:

Today, I had the honor of speaking with Ben Choi, a prominent community member with a huge amount of developmental expertise. Ben has been involved with EOS's governing structure and also, he is involved with the cryptocurrency project known as Theta; he is running a Theta node! Today, we discussed Ben Choi's opinions regarding the importance of DAO's (Decentralized Autonomous Organizations) within the cryptocurrency sphere, specifically, the ICON Ecosystem. We discussed ICONVIET's ContributionDAO proposal/application and its intricacies, EVA Cooperative, a DAO ride-sharing service being utilized in Canada and much more!

What “crypto ban”?

South Korea progresses bill to provide legal certainty for cryptocurrencies

South Korea’s National Assembly is progressing a bill that will provide a legal basis for cryptocurrencies in the country. The bill categorizes virtual currencies as digital assets and intends to bring regulatory clarity and transparency to crypto markets in South Korea, English-language newspaper Korea JoongAng Daily reports on Nov. 27.

According to the report, the bill was passed by the National Assembly’s national policy committee and still needs to be approved by the judiciary committee. If approved, the law would come into force in 2020, the report notes.

Kudos!

ICONLOOP has received a new accolade:

While it’s a bit hard to tell from the Korean-translated article how significant this distinction is, we’ll likely have more information over the coming days. Nonetheless, it’s always nice to see positive news for ICONLOOP.

Blockchain News

In a certain way, this was a bit of a banner week for cryptocurrency in terms of long-form journalism. There were two lengthy pieces in two of the most prominent magazines (at least in the United States).

The first, about the saga of Quadriga, is more intrigue than information, but there is definitely no shortage of intrigue! It’s a good read for anyone following cryptocurrency, but also for the general public as well:

When Canadian blockchain whiz Gerald Cotten died unexpectedly last year, hundreds of millions of dollars in investor funds vanished into the crypto ether. But when the banks, the law, and the forces of Reddit tried to track down the cash, it turned out the young mogul may not have been who he purported to be.

The second, in GQ magazine, is about cryptocurrency in general, and delves more into some individual personalities who have been caught up in the movement. While it doesn’t reach any clear conclusions, it’s another fun read for your weekend:

What is crypto? A couple years ago, crypto was the future, according to your cousin at Thanksgiving. It had something to do with Internet drugs in China? He couldn’t explain it very well; it sounded like another one of his schemes. But then, out of nowhere, crypto kind of was the future. Bitcoin bros the world over became millionaires. And then the bubble burst, everything went to hell, everyone consoled your cousin while breathing a sigh of relief, because crypto had disappeared, and none of you needed to figure out what the hell it had been. Only crypto didn’t disappear, it just went quiet. And this Thanksgiving, the evangelists will tell you it’s bigger, more relevant than ever, only they’re not just your cousin anymore.

Upbit’s CEO said in a blog post at 9:00 UTC on Wednesday that an abnormal transaction from its wallets had resulted in the outflow of 342,000 ether (ETH) earlier today.

The exchange said the loss will be covered by its own assets. Meanwhile, withdrawals and deposits have already been suspended as a precaution. The firm estimated that it will take “at least two weeks" for services to be back to normal.

Furious CZ from Binance suing The Block over market tanking ‘fake news’

Changpeng Zhao is taking cryptocurrency news and analysis website The Block to court after the startup refused to apologise for its November 21 story alleging that Binance’s Shanghai office had been shut down following a ‘police raid’.

CZ has branded the story “irresponsible” “fake news” and demanded an apology.

Is Walmart a Technology Company Incognito? - A short medium article describing Wal-Mart’s foray into blockchain technology, using both their own private chain as well as public ledgers (such as VeChain).

Bakkt hits new all-time high as Bitcoin investors ‘buy the dip’

U.S.-based Bitcoin futures exchange Bakkt has had a record-setting day today, with 2,735 contracts changing hands at 1 BTC apiece, for a new all-time high (ATH) daily trading volume of $19.85 million at current prices.