The Marketcap Fallacy (again), the S-Curve, and adoption

Welcome to this week’s edition of the Rhizome WIRE!

Over the past few weeks (and potentially months), I’ve seen some back and forth over a few related topics, all stemming from ICON’s (and crypto’s) potential for price growth in the coming months and years.

Generally speaking, those topics have been based around the following ideas:

The next bull-run won’t be anything like the prior bull run, and ICX will be lucky to hit ATH again

A belief that a multi-trillion dollar crypto market cap is unrealistic (which relates to the point above)

A frustration that the number of transactions on the ICON blockchain is insufficient and a signal of some sort of failure of the ICON team or project

I think all these points are related, either directly or indirectly, so let’s go into detail as to why I think that’s the case.

“We’re still early”

It’s likely you’ve seen this phrase before in the crypto universe. I’ve probably used it in one of these newsletters in the past. But that’s because it’s true.

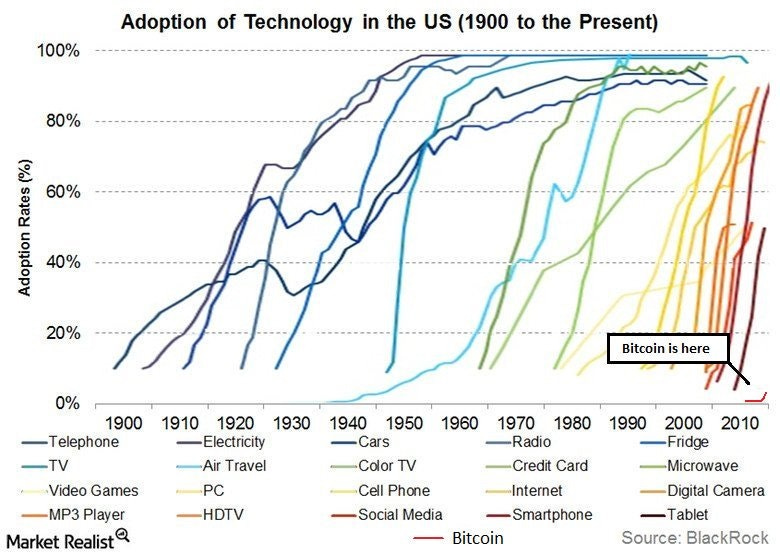

Let’s start by taking a look at this chart, which I’ve seen a few times before. It’s probably a tad out of date as it relates to the slight uptick in Bitcoin adoption over the past couple of years, but the premise still remains just as true:

I assume if you’re invested in Bitcoin, you’re invested because you believe at some point in the future its rate of adoption will exceed the single-digit percentages it’s at today.

Similarly, I assume if you’re invested in ICON, you’re invested because you believe at some point in the future its rate of adoption will exceed the sub-.01% it’s at today.

Will both ever hit 100%? Hard to tell. Will they someday be adopted at a higher rate than they are today? Almost certainly (and if you felt otherwise, why are you here?).

According to Coin Metrics, the number of Bitcoin wallets with at least $10 is around 18 million:

Meanwhile, the number of active (those that have actually transacted on the network) ICON wallets is just a bit under 500,000.

Of course, both of these metrics are an imperfect measurement of adoption, but they’re probably as close as we can get for the time being.

Now, I want to briefly turn to a tweet I came across this past week, as it related to news that POSTECH (essentially the MIT of Korea) is going to run a node on the ICON network:

Now, since the early days of ICON — around the ICO — the idea that ICON would become the blockchain of Korea was tossed around a bit (even generating the term “Korean Ethereum” which became more of a meme rather than an accurate description). Over time, as we reached the depths of the bear market, the “Korean Ethereum” idea was mocked a decent amount by bitter investors and outside observers.

Yet, to those who had followed the project, ICON has basically executed this vision about as well as one could have hoped.

South Korea has a population of at least 51 million people. So even if we assume all 500,000 of those active wallets are in South Korea (spoiler: they’re not), that’s a current adoption rate of…less than 1%. In just one country.

For those of you who have been in ICON since early days like I have, you may be wondering, after 3 years, why that adoption percentage isn’t yet higher. Similarly, you may also be wondering why the transaction count isn’t higher.

As I was thinking through this topic for this newsletter, I happen to stumble on a comment within the VeChain (another project gaining actual enterprise adoption) subreddit:

The value of partnerships with VeChain typically does not materialize within days, weeks or even months after these partnerships are established.

Im been seeing quite a few annoyed comments about how people are more interested in txs than partnerships. Well, the latter lead to the former; it just take YEARS to get an impressive number of txs.

Try to think about usage as following an exponentially trend: Painfully slow at first, then seemingly organic (deceptive) then super, almost incomprehensively fast, especially when network effects kick in.

I think you could say the same for ICON. It’s clear they’ve been lining up not only partnerships for years, but they’ve been following up on those with announcements that major institutions and enterprises would be using the ICON chain in some way, shape or form.

So, either they all just decided at once to revoke those plans without telling anyone, or we are in the process of steadily onboarding and scaling a nascent technology behind the scenes. Which do you think is more likely? If the latter, then you simply need to be a tad patient, and wait for this process to complete itself (which could take many more months, if not longer). If the former, then why are you still even invested in ICON and reading this?

So we’re basically at a point where:

The ceiling for further adoption is essentially infinite, since we’re so low on the S-curve (the chart I showed at the beginning of the newsletter)

There is a clear roadmap for significant institutional and enterprise adoption that is currently being implemented

This is essentially the optimal point to be an investor: still plenty of upside while a lot of the downside has been eliminated.

So, just how high is the limit?

In last week’s newsletter, I included the following Tweet:

Now, this $15 trillion number got some pushback and derision from some people (just look at the Tweet Justin was quoting), with the opinion being that this was far too significant. “That’s almost as large as the entire U.S. economy!”

I have long been a market cap skeptic. I am on the verge of becoming an extreme market cap skeptic, in the sense that I believe it’s almost totally unhelpful and provides less clarity more often than providing greater clarity.

Market cap has long been an imperfect metric for crypto, and is far better suited for traditional equities. For instance, in the case of the stock market, the price should — for the most part — be a reflection of what people believe the company is worth (due to the fact they are owning a portion of it). In that sense, multiplying shares outstanding times the price gives a reasonable approximation of what the company as a whole is worth.

In crypto, the price reflects what the most recent person was willing to pay for it. Supply and demand plays a role in this, of course. But someone doesn’t buy an ICX because they believe it entitles them to ownership of the ICON Foundation. They buy it because they think it will go up over time.

So if people aren’t buying (and thus evaluating) tokens based on their intrinsic worth, why are we using that as part of a metric to determine a project’s total value? To take it another step, why are we then using that calculation to compare a crypto project to, say, Apple? Simply put, a token’s intrinsic value is essentially that it provides its owner with the ability to transact on that network. How can you reasonably compare that to ownership of a company?

This calculation is ultimately limiting our imagination of what prices are actually attainable. This alone isn’t a big deal, but it becomes contradictory if you buy into the analysis laid out above.

Let’s assume Bitcoin adoption is at 2% of what will one day eventually be 100%. Here is a chart from well-known chartist Dave the Wave (link is behind a paywall), with the assumption we are indeed at 2%:

Here’s how that chart looks compared to the S-Curve image I posted at the very beginning of this newsletter:

And here’s a quote from Dave the Wave:

And so we have the rationale for the projected price of 500,000 USD at mass adoption based on a current 2% adoption as charted in figure 3 above. The reader may be thinking that this is all very well, but all very speculative. And yes, it is speculation, but it’s also rational speculation…

At today’s BTC circulating supply, $500,000 per BTC is a market cap of about $9.2 trillion. But that’s just BTC, which theoretically has the lowest remaining growth ceiling of all crypto (due to the fact it’s much further along the adoption curve).

Now do similar math for the many potentially successful blockchain projects that still have a long way to grow in the coming years, and you’ll start to see that comparing crypto market cap to traditional market cap becomes silly, and that $15 trillion doesn’t seem so outlandish.

Based on what I’ve laid out above, the thought process behind putting a low ceiling on the price of ICX begins to sound a bit irrational:

“Well, I’ve bought into a project that has microscopic adoption levels at the moment, but has tremendous potential to scale based on a current positive trajectory of adoption. But I don’t think it will get much higher than $10, because that means its market cap will exceed a company I’ve arbitrarily decided to compare it to.”

Doesn’t make much sense, does it?

My new personal rule for thinking about market cap is to remove the dollar sign. That way it becomes an evaluation just based on a number, without a comparable analogue in the real world. It allows me to evaluate the historical scale of a project, as well as evaluate the magnitude of a project relative to the market as a whole, but also prevents me from foolishly comparing a network protocol (ICON) to a hardware manufacturing company (Apple).

The better approach is to try to estimate to what extent you believe the project has currently been adopted. You should then try to estimate what level of adoption seems likely or realistic for that project. You should then try to estimate what the price would be at that level of adoption.

What if 25% of the South Korean population (~12.5 million people) used the ICON network on a daily basis in some shape or form in 5 years? What about 50%? 100%?

What if ICON ever expands beyond South Korea? That’s an idea that may not be that far fetched…

Ultimately, in crypto, it’s sometimes better to be imaginative rather than “realistic.” The people who were “realistic” probably sold their BTC at $10.

News from ICON World

Staky (formerly Sharpn) announced a new and upcoming NFT marketplace for ICON

Catalyst shares thoughts on the most recent I-Rep vote and more

ICONFi has surpassed $20M in capital commitment before launch

CCBR at POSTECH has joined the ICON network!

ICX gets listed on Hotbit Korea

ICON November 2020 monthly development update has been released

Blockchain Industry News

OCC Chief Hints at Coming ‘Good’ Actions on Crypto by End of Trump’s Term - CoinDesk

Brooks refused to directly answer show hosts’ questions about the rumored self-hosted wallet regulation supposedly coming out of the Treasury Department. Last week, Brooks’ former boss, Coinbase CEO Brian Armstrong, publicly suggested on Twitter that his current one, Treasury Secretary Steve Mnuchin, would stifle crypto innovation with a slap-dash final regulatory push.

Layer-2 Ethereum scaling solution OMG Network gets acquired by a venture firm - The Block

Layer-2 Ethereum scaling solution OMG Network has been acquired by Genesis Block Ventures (GBV). GBV is a subsidiary of Genesis Block, a Hong Kong-based crypto over-the-counter (OTC) trading firm. Financial terms of the acquisitionwere not disclosed.