The marketcap fallacy

Welcome to this week’s edition of RHIZOME Wire!

The marketcap fallacy

Ever since the beginning of the bear market and the slide in price of ICX, many in the community have placed a laser-like focus on the projects ranking when it comes to market cap. Specifically, they look at the popular website, CoinMarketCap, and see how ICON stands relative to other projects.

Typically, when it is pointed out that not just ICON has suffered during this bear market, a frequent response is something along the lines of “But look at our ranking on CoinMarketCap! We’ve continued to fall!” as though the CoinMarketCap rankings were an underlying valuation of the strength of a product, rather than a simple multiplication formula comprised of price x circulating supply. Here is an example of such sentiment, as pulled from Twitter over just the past couple of days:

Similar sentiment has also spread across reddit, Telegram, and other platforms.

I’d like to spend a bit of time explaining why using marketcap to value a project, or to value a project relative to others, isn’t an accurate way to gauge the quality of a project.

The origins of CoinMarketCap

Let’s take a look at a blog post from CoinMarketCap explaining its origins:

After a few months of ruminating about how to best measure these cryptocurrencies, he had come across the financial section of a news site describing the market capitalization of equities. It struck him that such a metric would be useful and familiar for those already comfortable with some of these financial terms, and decided this was how he could best present the relative sizes of altcoins.

In other words, without an immediate and apparent way to value cryptocurrency projects, the founder of CoinMarketCap decided to borrow a metric from traditional finance in order to ascertain the value of projects. From that point on, this notion became the default mechanism for valuing cryptocurrency projects. However, there are a few problems with this approach:

Market cap as used in traditional finance is calculated using stock price multiplied by the number of issued shares. A stock price is tied to a company’s earnings, prospects for future earnings growth, dividends (if applicable), and other documentable and tangible factors. Cryptocurrency has none of these things. It’s price is based almost entirely on speculative value—it is essentially based upon what the market believes it to be worth. In traditional markets, demand also plays a role in price, but it’s typically rooted in the financial factors described above.

The number of shares in existence is typically a static number. Sure, it can vary from time to time—especially when it comes to stock splits—but it tends to remain stagnant. In other words, price fluctuations are what lead to changes in market cap, not fluctuations in shares. Meanwhile, in crypto, the supply of tokens fluctuates significantly. As I write this, the circulating supply of tokens such as Tezos, Dogecoin, and ICON (just as a small sampling) have all slightly increased. That means, assuming their price remains constant (as it has), their market cap has gone up.

A market cap in traditional finance is used to evaluate the size of companies. Companies with factories, employees, products, cash flows, patents, and other tangible factors. Cryptocurrency projects, on the other hand, are far less tangible. They are also incredibly diverse. Bitcoin’s purpose and value proposition is far different than Ethereum. VeChain's supply-chain use case is far different than ICON’s promise of interoperability. Using market cap to value all of these projects is the equivalent of valuing a currency and the internet in the same manner.

Does this mean market cap is useless in cryptocurrency? Not necessarily. It can help to give context to why XRP isn’t really as “cheap” as it may seem compared to Bitcoin, since it looks beyond simply price. However, I think it must be taken with a grain of salt, considering the factors listed above.

Context is important

Maybe you’re not convinced by my argument above. That’s fine. Let’s assume you believe marketcap is still a good way of evaluating a project.

But even if that’s the case, should it really be the only way?

Instead of simply looking at one number - CMC Ranking - as a way to evaluate a project, it makes more sense to look at the complete picture. Perhaps ask yourself the following questions.

For those projects that have surpassed ICX on the rankings: ask yourself, what are they doing better that makes them “better” than ICX? Do we really believe that Bitcoin Diamond and NEM — two tokens that were identified as “dead” by CoinDesk — are better long-term investments than ICON?

Does it matter that several stable coins have been added over the last couple of years at a higher market cap than ICON?

If ICON’s price was $0.17 at the time of this writing — putting them around #50 in the CMC rankings (rather than around #70) — would your foundational confidence and belief in the project be significantly different?

If other projects have surpassed ICON in the last two years in ranking, does that make ICON a bad long-term investment?

If the market takes off and every token, including ICX, grows by 100x, would it still bother you that ICON is #70? Would it bother you if it grew only 99x and fell to #80?

There are 4,950 tokens listed on CoinMarketCap. Isn’t it more relevant that ICX is remains firmly among the Top 1.5%, rather than being upset its no longer among the Top 1%?

This is just a small example of why looking solely at the relative ranking on CMC isn’t all that helpful or informative.

Does it suck that ICX is no longer $12? Yes. Did other projects either see a smaller price decline, or a larger subsequent price increase? Yes. Do those facts alone mean ICON is an inferior project? No.

Stop looking at price. Stop looking at rankings. Pay attention to fundamentals.

News from ICON World

More media focus on my-ID

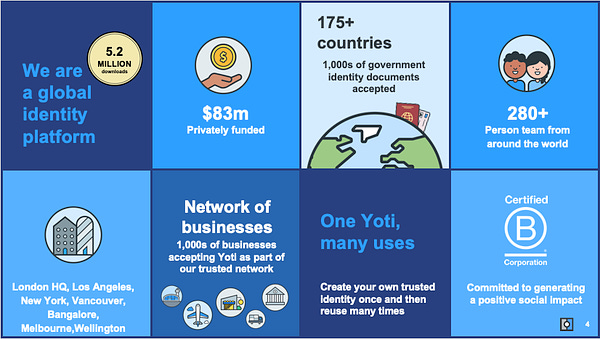

In a story about the gradual adoption of DID, The Block Post (in a translated article), discussed how YOTI, one of the participants in the my-ID Alliance, currently implements their digital ID:

In the UK, when buying age-restricted items such as cigarettes or lotteries at convenience stores, a service that allows people to verify their age using blockchain mobile identity card YOTI is popular. Through this, the user can confirm his / her age without revealing personal information such as name and address that were previously exposed when presenting an identification card such as a driver's license to a convenience store.

You can also prove your identity with Yoti when you sign real estate or trade goods online. This allows you to verify your identity in seconds without the need for a photo ID or document, which speeds up service delivery and reduces the cost of processing a service.

In addition, users can easily log in through Yotti without having to sign up on different homepages each time, or enter a password to reduce the burden of remembering the subscription information.

Some additional context:

Another step toward adoption!

Metanyx has released “ICONPay for WooCommerce,” which will provide merchants operating WooCommerce (a Wordpress Plugin) the ability to allow payment in ICX:

ICONPay for WooCommerce allows users to pay and merchants to accept ICX CryptoCurrency on their online store. Over 3 million onlines are powered by WooCommerce and growing everyday. Receive payments from anyone in the world quickly and easily.

ICONPay performs real time transactions without an intermediate gateway. The speed of the ICON blockchain makes it possible to use ICX for real time commerce unlike first and second generation blockchains such as Bitcoin and Ethereum which have confirmation times ranging from a couple minutes to hours depending on network usage.

Mobile Staking now available for Android

At least, the long wait is over as Android users can now stake from the mobile ICONex app:

MetrICX now available on iOS!

RHIZOME’s app, MetrICX, is now available for iOS users:

ZenSports Upgraded!

ZenSports, the peer-to-peer sports betting app, has been upgraded. As you may know, ZenSports’ internal token, SPORTS, runs on the ICON public chain. Here is the motivation for the upgrade:

We want our customers to feel emotionally connected to the teams and players that they’re following, betting on, and managing. We want our customers to feel excited when they get a notification that someone has accepted their bet or that bet results have been submitted. We want our customers to want to promote our product to their friends, colleagues, and families. Our new design accomplishes these product goals.

Transactions, transactions, transactions

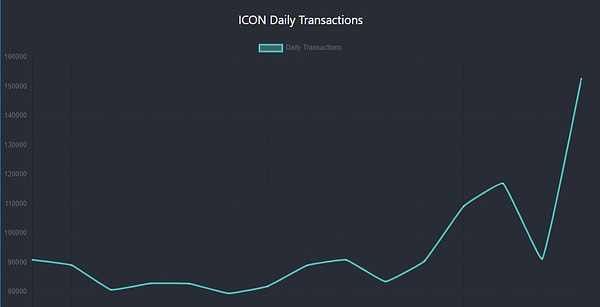

This week, we saw a spike in ICX transactions:

While we’re still along ways off from the millions of transactions per day we hope to see someday, it’s nonetheless nice to see gradual progress. (I still remember the excitement when we first reached 30,000 transactions not too long ago!)

Blockchain Industry News

Teen crook hacked into 75 phones and stole $1M in cryptocurrency: authorities (NY Post)

An alleged teen crook stole the identities of 75 people and swiped $1 million in cryptocurrency — all from the comfort of his Brooklyn apartment, authorities said.

Yousef Selassie, 19, used a sophisticated SIM-swapping scheme to take over the phones of people in 20 different states between Jan. 20 and May 19, 2019, according to the Manhattan District Attorney’s Office.

Trader loses $26 million in one week as Bitcoin slumps to $6,500 (Coinrivet)

One trader has lost $26 million on Bitfinex this week during Bitcoin’s descent from $7,200 to $6,500.

According to the exchange’s leaderboard, a trader who goes by the username JOE007 has lost a grand total of $26,136,000 by trying to long Bitcoin while it’s in a downtrend.

The trader’s losses correlate with the steady rise in the amount of Bitcoin being locked in long positions on Bitfinex, with the amount rising to 47,157 BTC from 26,660 BTC on November 22.

VITALIK BUTERIN: ETHEREUM FOUNDATION MADE $100 MILLION BY SELLING ETH AT ATH (Bitcoinist)

According to a recent statement by Vitalik Buterin, he managed to convince the Ethereum Foundation to sell 70,000 ETH at the height of 2017’s parabolic run, resulting in a $100 million liquidity.

Cryptocurrencies Are Still the World’s Best Performing Asset Class This Year (Coindesk)

Despite trading significantly down from their record highs of late December 2017, large-cap cryptocurrencies had a phenomenal year and remain one of the greatest investment success stories of the decade.

Cementing themselves as the world’s leading asset class for yearly performance, cryptocurrencies have risen well above annualized returns of the U.S. equities, commodities and bond markets for 2019.

Fidelity Digital Assets intends to support Ethereum in 2020 (Yahoo! Finance)

If the client demand is there, then Fidelity Digital Assets could support Ethereum in 2020.

In a recent episode of The Scoop, the venture's president Tom Jessop told The Block that the firm has "done a lot of work on Ethereum" when asked if they would soon offer custody for the digital currency. Launched at the beginning of 2019, Fidelity Digital Assets (FDAS) offers cryptocurrency custody and trading tools for institutional investors and traders. Still, the firm has only supported bitcoin — a fact that some say keeps FDAS from truly competing with crypto-native firms like Coinbase and BitGo.

What’s new in blockchain mining

CoinShares, a blockchain asset management firm, has released their report on the Bitcoin mining industry:

In this fourth edition of our biannual report we investigate the geographic distribution, composition, efficiency, electricity consumption and electricity sources of the Bitcoin mining network.

Oh no Binance what is you doing?